Some key report findings for all Michigan energy types:

- Use of natural gas is expected to see a 3.8% increase in 2024, led by increased demand from the electric power generation sector outweighing declines in the commercial (-2.2%) and industrial (-3.3%) sectors. Residential consumption is expected to be nearly flat year over year.

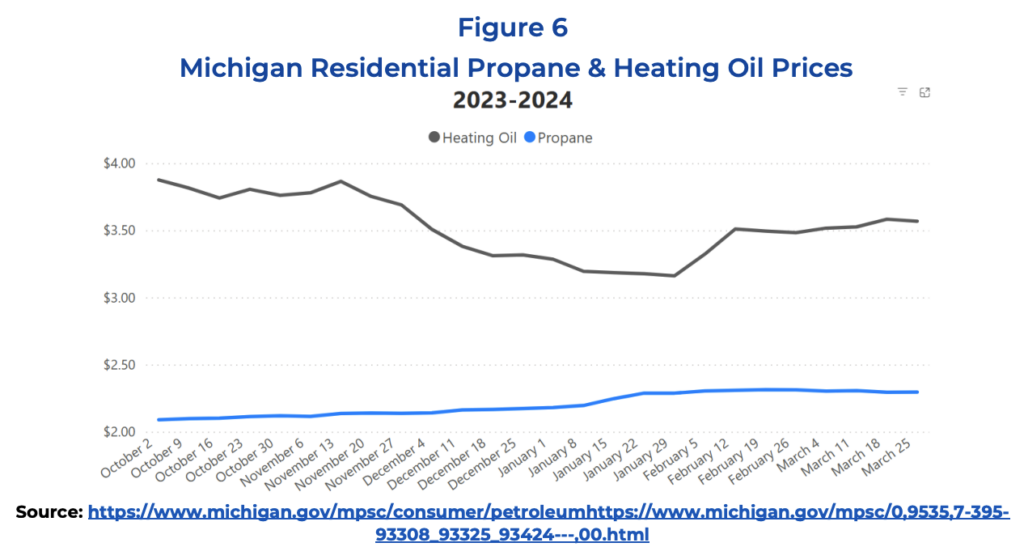

- Residential propane prices beginning in October 2024 averaged $2.17/gallon, an increase of 8 cents (3.8%) compared to last year. ▪ No. 2 heating oil prices started the 2024/25 heating season $0.78/gallon (20%) lower than last year at an average of $3.10/gallon.

- Electricity demand is forecast to increase 2% for 2024. The largest gains are expected in the residential sector (3.8%), with the commercial sector also up (2.6%) while industrial electricity consumption decreases (-0.8%). The EIA forecasts residential retail electricity prices in the east north central U.S. to average 16.31 cents/kWh for 2024, an increase of 0.7% from 2023, and average 16.66 cents/kWh in 2025.

- Midwest gasoline prices are expected to average $3.20/gallon for 2024 and $3.06 in 2025. Michigan gasoline demand is projected to increase 0.3% for 2024, following a decline of 0.8% in 2023.

Executive Summary from the Michigan Public Service Commission

Energy use in Michigan is closely tied to economic activity within the state. Motorists use gasoline to travel to and from work, companies move goods throughout the state by trucks and trains powered by diesel fuel, the industrial sector uses natural gas as a fuel for their manufacturing processes, and all sectors use electricity to light either their homes, businesses, or factories. Of note for this Energy Appraisal is the current price volatility within energy markets and the uncertainty surrounding future price projections. The EIA geographically aggregates price projections into Petroleum Administration Defense Districts (PADDs) – which means prices in individual states may eclipse the regional PADD average for a given forecast period.

Propane Demand

Supply U.S.

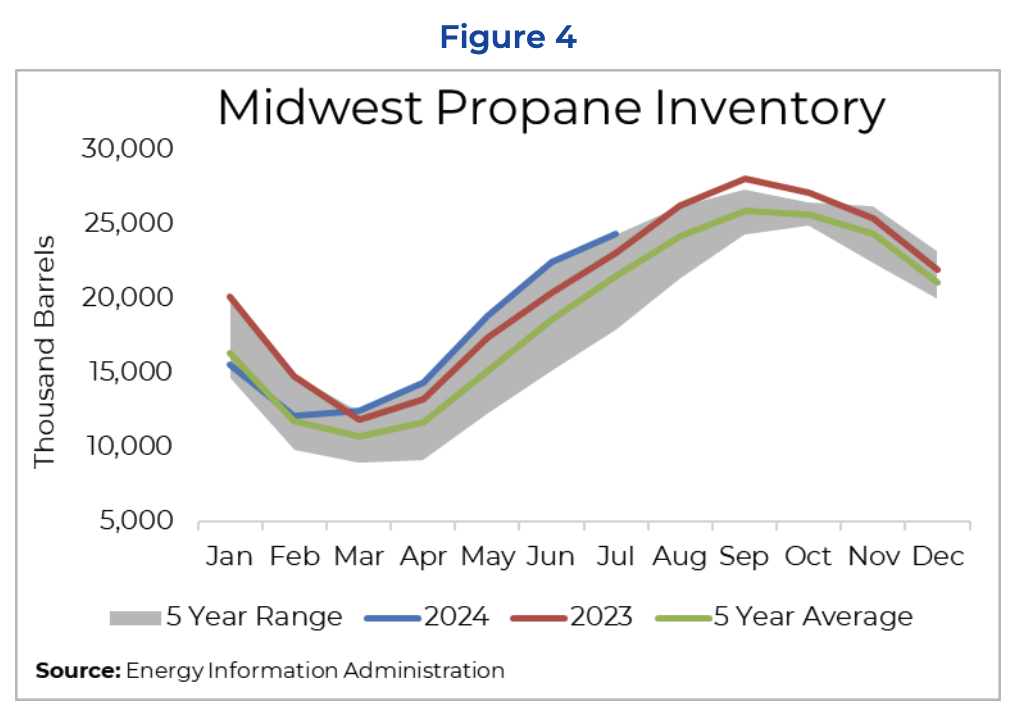

Propane production remains high – averaging 2.76 million b/d to end November as propane export demand continues to be strong. A significant portion of U.S. propane exports leave from the Gulf Coast, destined for nations such as Japan, China, South Korea, and Mexico. The average Midwest propane production for the week ending November 22, 2024 was 555,000 b/d, an increase of 1.5% from the same period last year. According to the EIA, U.S. inventories of propane and propylene stood at 96.7 million barrels as of November 22, 2024, only 2% below levels seen at the same time last year. PADD 2 (Midwest) propane and propylene stocks (see Figure 4) totaled 27.5 million barrels as of November 22, 2024 (up 400 thousand barrels from 2023), 10% above the five-year average for this time of year.

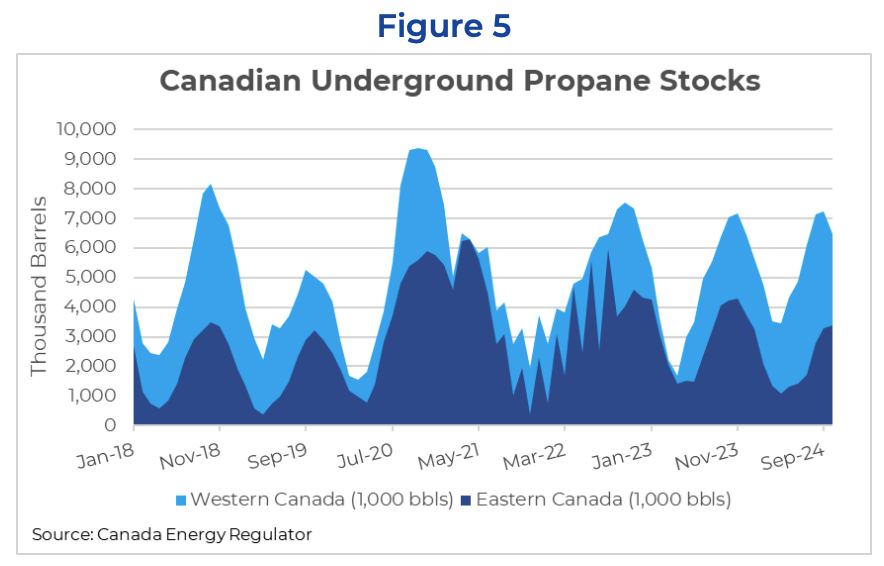

In addition to domestic propane supply, many regions of the U.S. rely on supplies from Canada that are transported by pipeline, rail, and truck. Major Canadian underground storage facilities are primarily located in western Canada (Alberta) and in eastern Canada (Ontario). According to the MPSC’s 2019 Statewide Energy Assessment, approximately 18.7 million barrels of underground cavern storage capacity for hydrocarbon gas liquids, such as propane, are located in Ontario near the Sarnia and Windsor areas. According to Canada Energy Regulator data, underground propane stocks to begin in October 2024 totaled 3.4 million barrels in eastern Canada, and 6.5 million barrels in western Canada – 10% below and 0.2% above five-year averages for the time period, respectively (see Figure 5).

Price

According to the EIA, wholesale propane prices in Michigan started this heating season at $0.93 per gallon (6 cents higher than prior year). However, oil and natural gas prices – which feed into propane prices – can at times be an upside risk for prices paid for propane later in the winter, especially during extreme cold events when demand is highest. For the week of November 25, 2024, the average residential propane price in Michigan was around $2.21 per gallon. As seen in Figure 6, propane prices were quite stable throughout last heating season.